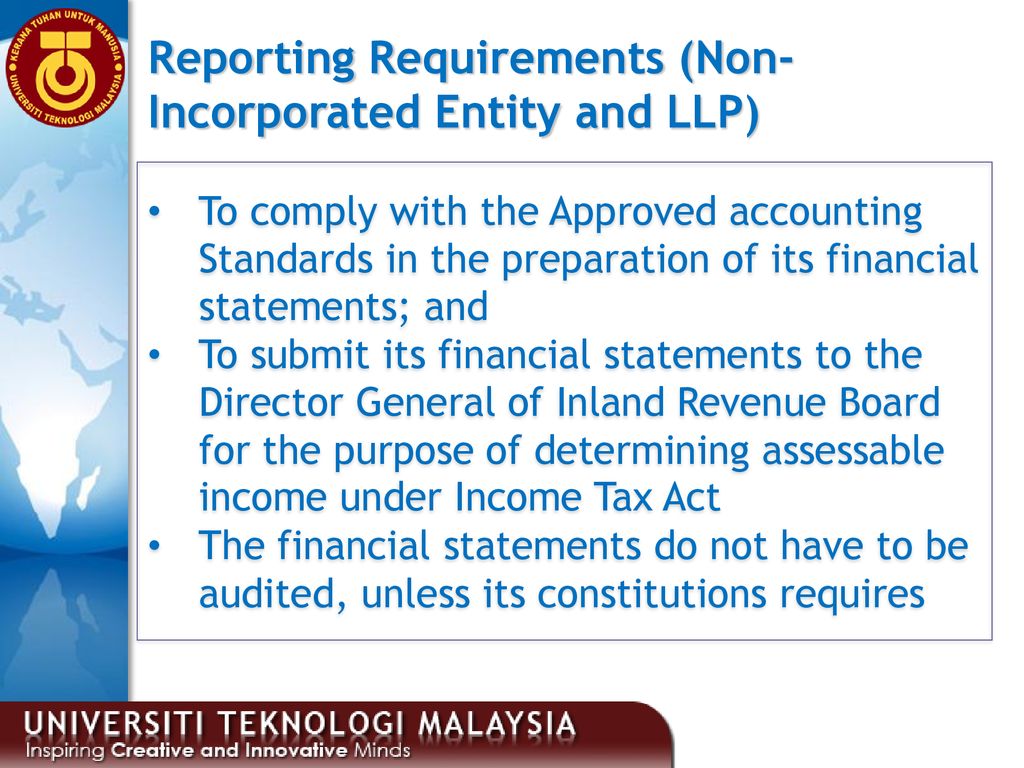

GBEs apply approved accounting standards which are issued by the Malaysian Accounting Standards Board MASB either MFRS or MPERS. 15 of 2013 stipulates that financial statements for all companies must be prepared in accordance with IFRS or IFRS for SMEs.

Accounting In Malaysia Accounting Requirements For Malaysia Companies

These companies must have no more than 20 members and none of whom are corporations having a direct or indirect interest in its shares.

. Companies registered in Malaysia are required to prepare statutory financial statements in accordance with the approved accounting standards issued by the Malaysian Accounting Standards Board MASB. MASB - Malaysian Accounting Standards Board. The total assets in the current statement of financial position of.

Interest royalties contract and other service fees lease rentals for movable property and technical fees. The Preface to Malaysian Public Sector Accounting Standards issued by the Accountant Generals Department explains that GBEs apply approved accounting standards issued by the Malaysian Accounting Standards Board MASB. Three requirements must be met for the company to be eligible for audit exemption.

Lead bank Regulators. The International Public Sector Accounting Standards Board IPSASB an independent standard-setting body under IFAC is responsible for the issuance of IPSAS. These Audit Risk standards gave rise to conforming amendments to various standards as indicated in the explanatory foreword to the respective standards.

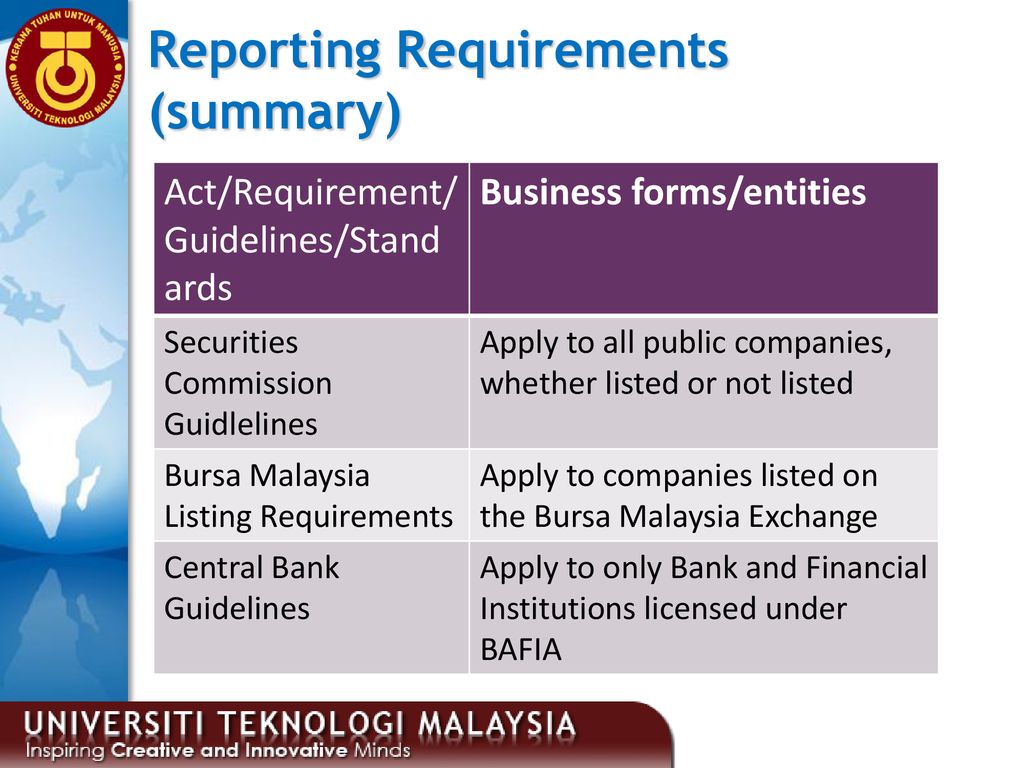

BNM has broad powers of supervision and control over banking institutions licensed under the FSA and the IFSA. Withholding tax rates are 10 15 or 20 of the gross payment. MASB Approved Accounting Standards for Entities Other than Private Entities MASB Approved Accounting Standards for Private Entities.

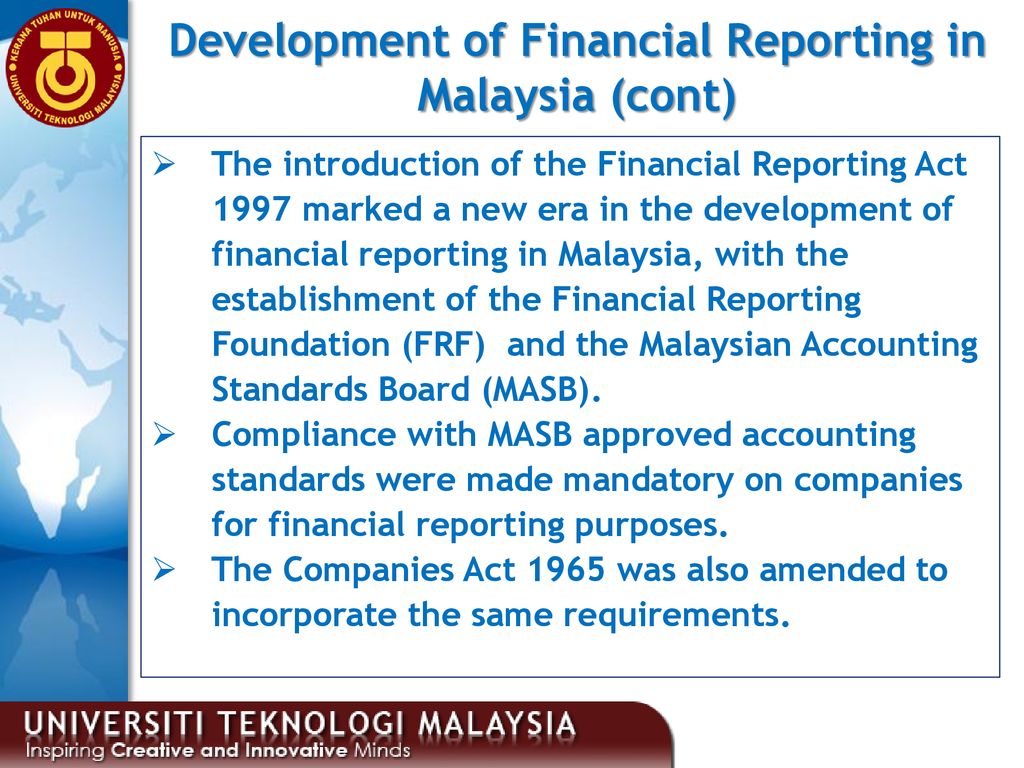

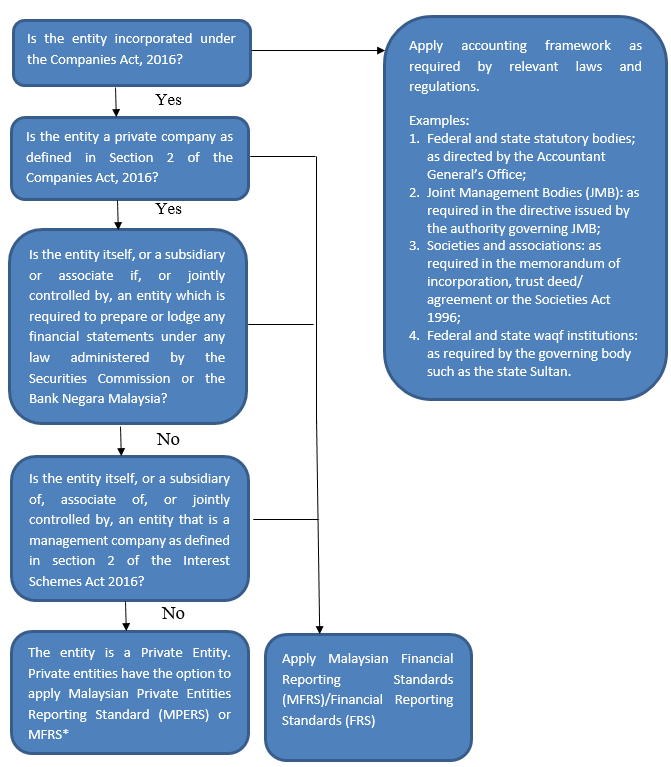

It is established under Financial Reporting Act 1997 as an independent authority to develop and issue accounting and financial reporting standards in Malaysia. The Types of Approved Accounting Standards in Malaysia. Foreign companies listed on a stock exchange in Malaysia may prepare financial statements in accordance with certain internationally recognised.

MPSAS 1 defines GBEs as an entity that has all the following characteristics. Malaysia operates a self-assessment tax system and tax returns must be filed within seven months of the companys year-end. Accounting Standards used by Malaysian finance professionals 1.

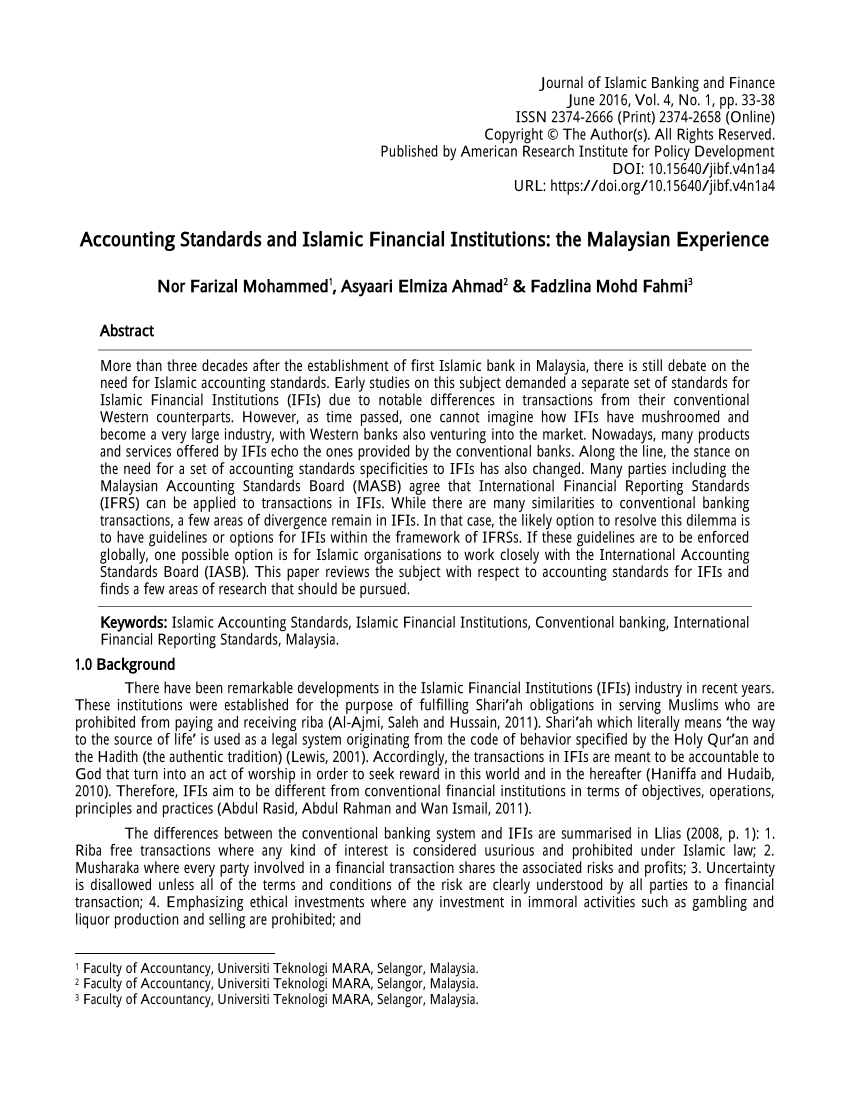

Accounting standards relate to a set of rules used to record financial transactions and estimates within the entitys books. Financial Assets and Liabilities Classification and Measurements Malaysian firms will have to classify their financial assets with respect to the business model and cash flow characteristics. Section 7 of the Financial Reporting Act 1997 FRA empowers the Malaysian Accounting Standards Board to issue approved accounting standards for application in Malaysia.

The conforming amendments are effective for audits of financial statements for periods beginning on or after 1 January 2006 and have been incorporated in the text of these standards. Under the Financial Reporting Act of 1997 the Malaysian Accounting Standards Board MASB was established as an independent authority to develop and issue accounting standards for the preparation of financial statements which are required to be prepared under laws administered by the Securities Commission the Central Bank or the Registrar of Companies in Malaysia. Accounting Standards Accounting standards are issued by the Malaysian Accounting Standards Board MASB by virtue of the power conferred by the Financial Reporting Act 1997.

Entities generally are required to prepare their financial statements according to Malaysian Financial Reporting Standards MFRS equivalent to IFRS except for private entities that continue to follow Private Entity Reporting Standards PERS for financial statements with annual periods beginning before 1 January 2016 and the Malaysian Private. Companies are liable to pay withholding tax on the following types of payment made to a non-resident. Thus as a business you will have to go through all.

Is an entity with the power to contract in its own name has been assigned the financial and operational authority to carry on a business. There are two standards that you can apply in Malaysia. Accounting Standards The Companies Act Act No.

Under section 26D of the FRA financial statements that are prepared or lodged with the Central Bank Securities Commission or Registrar of Companies are required to comply. This Standard applies to all public sector entities other than Government Business Enterprises GBEs. The Malaysian Financial Reporting Standards MFRS This is the MASB approved accounting standards for entities but this does not include private entities.

Private Entity Reporting Standards PERS This is the MASB approved accounting. In discharging its supervisory functions BNM adopts. Certain companies are exempt from filing audited accounts.

Companies that are considered public interest entities PIEs must use full IFRS while all other companies may choose to use full IFRS or IFRS for SMEs. Bank Negara Malaysia BNM is empowered to act as the regulator of banking institutions under the FSA the IFSA and the Central Bank of Malaysia Act 2009 CBA. Accounting Standard Rules And Regulations In Malaysia - Setting The Financial Accounting Standards In Malaysia The Malaysian Accounting Standards Board Masb And The Accounting Profession 1997 1999 Semantic Scholar - The family and medical leave act a federal law that allows employees to take time off work for medical conditions and specific family.

GASAC considers IPSAS standards issued by IPSASB for adoption in Malaysia. There are three types of approved accounting standards here in Malaysia. Effective 1 September 2018 Malaysia Goods and Services Tax GST was replaced by a Sales and.

The Financial Reporting Act also establishes the Financial Reporting Foundation which is the body that is responsible to oversee MASBs performance and financial arrangement. They are mainly based on the. Have an annual revenue of RM 100000 or less during the financial year and the past two years.

Malaysian Financial Reporting Standards MFRS MFRS are used by larger business entities in Malaysia. MPSAS standards are not exactly the same or word-for-word IPSAS.

National Adoptions Of Ifrs Accounting Perspectives Intechopen

Pdf Accrual Accounting Change Malaysian Public Sector Readiness

Pdf The Influence Of International Accounting Standards On The Economic Development Aftermath Of Covid 19

Accounting In Malaysia Accounting Requirements For Malaysia Companies

Overview Of Accounting Ppt Download

Pdf Accounting Standards And Islamic Financial Institutions The Malaysian Experience

Lecture 1 Introduction To Accounting What Is Accounting

Pdf The Adoption Of International Accounting Standard Ias 12 Income Taxes Convergence Or Divergence With Local Accounting Standards In Selected Asean Countries

Overview Of Accounting Ppt Download

Accounting Standard L Co Chartered Accountants

An Idiot S Guide To Accounting Standards In Malaysia

Lecture 1 Introduction To Accounting What Is Accounting

Overview Of Financial Reporting Environment

Indian Accounting Standards Applicability And Benefits Enterslice

Overview Of Accounting Ppt Download

Overview Of Financial Reporting Environment